steamboat springs colorado sales tax rate

Chaser within the City limits. 136 6th Street Suite 111.

News Flash Steamboat Springs Co Civicengage

What is the total sales tax rate I should charge in the City of Steamboat Springs.

. This tax also feeds into the Steamboat Springs Public Education Fund at the same half-cent rate as the normal sales tax rate. The County sales tax rate is. The minimum combined 2022 sales tax rate for Steamboat Springs Colorado is.

Who Needs a Sales Tax License. View details map and photos of this single family property with 4 bedrooms and 2 total baths. 10 rows The City of Steamboat Springs is a home rule municipality with its own Municipal Code.

Strnad Finance Director Email Dan Accounting Budget. Up to 24 cash back Steamboat springs colorado sales tax rate Tax debts in Colorado Springs are often caused by back taxes that were not fully paid when they were to be paid and have rolled over to another tax year. Exemptions County Municipality and Special District SalesUse Tax Exemptions Options.

The Steamboat Springs sales tax rate is 45 Steamboat Springs accommo-dations tax rate is 1 of the retail purchase price. The Steamboat Springs sales tax rate is. September Final Sales Tax Report.

Live in Routt County. Please contact us for additional information regarding sales taxes on lodging. Tax Jurisdiction Tax Rate State of Colorado 29 Routt County 10 City of Steamboat Springs 45 Total combined sales tax rate inside the City 84 Documentation provided outside City no permits or certificates 84 39 County building permits 74 29 City building permits 29 29 sales tax licenses 00 00 exemption certificates 00 00.

The sales tax is remitted on the DR 0100 Retail Sales Tax Return. Buyer and seller both in Hayden. The steamboat springs sales tax rate is.

If this debt is not unpaid it collects interest and penalties in such a way that it may seem insurmountable. Monthly Sales Taxes Are 1755 Higher Compared to Same Time Last Year. For Immediate Release 137 10th Street PO.

Did South Dakota v. The Steamboat Springs Colorado sales tax is 840 consisting of 290 Colorado state sales tax and 550 Steamboat Springs local sales taxesThe local sales tax consists of a 100 county sales tax and a 450 city sales tax. As of 1117 84 45 city 29 state and 1 county.

Buyer and seller both in Oak Creek. The Colorado sales tax rate is currently. Steamboat Springs in Colorado has a tax rate of 84 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Steamboat Springs totaling 55.

As of 1117 84 45 City 29 State and 1 County. For Sale - 1360 Indian Trail 13 Steamboat Springs CO - 469900. Retailers Anyone engaged in the business of making retail sales.

Routt county colorado has a maximum sales tax rate of 84 and an approximate population of 16637. Additional salesuse tax exemptions can be found at ColoradogovTax. 6 rows The Steamboat Springs Colorado sales tax is 290 the same as the Colorado state.

Tax Jurisdiction Tax Rate State of Colorado 29 Routt County 10 City of Steamboat Springs 45 Total combined sales tax rate inside the City 84 Documentation provided outside City no permits or certificates 84 39 County building permits 74 29 City building permits 29 29 sales tax licenses 00 00 exemption certificates 00 00. Steamboat Springs CO 80487. City of Steamboat Springs Sales Tax Department PO Box 772869 Steamboat Springs CO 80477-2869 Sales Tax Department 137 10th Street PO Box 772869 Steamboat Springs CO 80477 Phone.

The Steamboat Springs Sales Tax is collected by the merchant on all qualifying sales made within Steamboat Springs. The August 2021 sales taxes for the City of Steamboat Springs are 1666 higher compared to. STEAMBOAT SPRINGS COLORADO-September 30 2021-The City of Steamboat Springs has published the August 2021 Preliminary Sales Use Accommodation Tax Report see the report.

The steamboat springs colorado general sales tax rate is 29. 4 rows The 84 sales tax rate in Steamboat Springs consists of 29 Colorado state sales. Tax Rates City Sales Tax 40 School Tax 05 City of Steamboat Springs REMIT TO CITY 45 City Accommodations REMIT TO CITY 10 State of Colorado REMIT TO STATE 29 Routt County REMIT TO STATE 10 Total Combined Tax Rate 94 LMD Accommodations Tax REMIT TO STATE 20.

The Building Use Tax also collected a high number 4 million in 2021 as compared to 23 million in 2020. What is the sales tax rate in Steamboat Springs Colorado. The Colorado sales tax Service Fee rate also known as Vendors Fee is 00400 40 with a Cap of 100000.

Chaser within the city limits. This is the total of state county and city sales tax rates. Lessors Anyone renting or leasing tangible personal property.

When groceries go up by 20 so does sales tax said Kim Weber the citys finance director. Live in Steamboat Springs. You can find more tax rates and allowances for Steamboat Springs and.

2022 Tv Wall Mount Installation Cost Calculator Steamboat Springs Colorado Manta

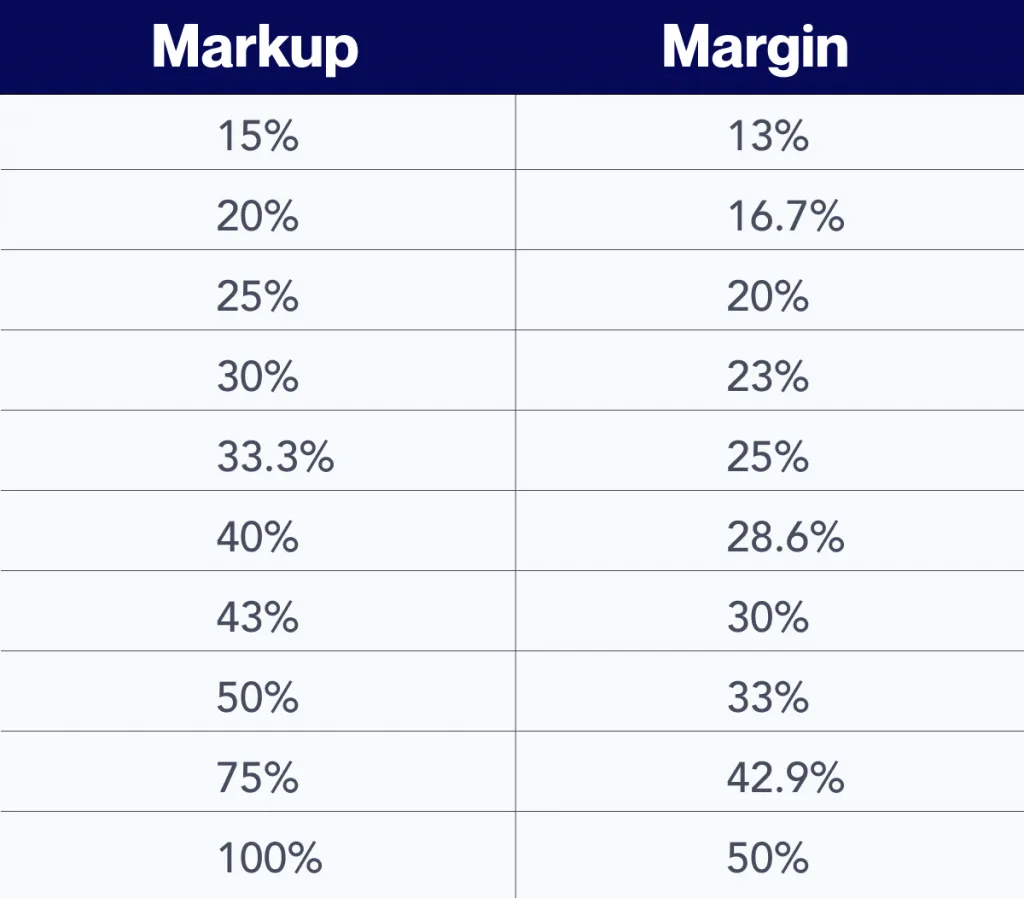

Margin Vs Markup Calculating Both For Your Alcohol Brand Overproof

Tobacco Taxes Pass In Glenwood Springs And New Castle Postindependent Com

With The Astronomical Health Benefits Of This Plant Don T Knock It Till You Try It If You Re Lucky Enough To Magic Symbols Health Benefits Comic Book Cover

Is Food Taxable In Colorado Taxjar

2022 Tv Wall Mount Installation Cost Calculator Steamboat Springs Colorado Manta

Is Food Taxable In Colorado Taxjar

Is Food Taxable In Colorado Taxjar

Pin On Home Is Where My Heart Is

Colorado Springs Co Real Estate House Value Index Trend And Various Statistics Such As Weather Transportation Unemployment Colorado Springs Colorado Springs

Help I Don T Know What To Enter For Locality Grou

Florida State Flag Florida State Flag Florida Flag State Of Florida

Steamboat Resort Announces Huge Development Plans Steamboat Ski Resort Resort Ski Resort

Magnificent Kahana Estate Luxury Homes House Property Home

Short Sale Vs Foreclosure Simple Facts Foreclosures Mortgage Tips Shorts Sale

The Yampa River 101 River Steamboat Springs Colorado

Is Food Taxable In Colorado Taxjar

Alpenglow Village On The Horizon Apartment Communities Affordable Housing Village